最新消息:

最新消息:台湾六合彩【五肖十码】

| 045期五肖:龙马猪兔狗 |

| 045期四肖:龙马猪兔 |

| 045期三肖:龙马猪 |

| 045期二肖:龙马 |

| 045期一肖:龙 |

045期⑩码:01.11.06.02.07.13.23.18.14.31 |

| 045期⑤码:01.11.06.02.07 |

| 台湾六合彩官方指定网129370.com |

| 044期五肖:鸡羊猪狗虎 |

| 044期四肖:鸡羊猪狗 |

| 044期三肖:鸡羊猪 |

| 044期二肖:鸡羊 |

| 044期一肖:鸡 |

044期⑩码:44.46.30.07.39.32.22.18.19.15 |

| 044期⑤码:44.46.30.07.39 |

| 台湾六合彩官方指定网129370.com |

| 043期五肖:猪蛇鸡狗牛 |

| 043期四肖:猪蛇鸡狗 |

| 043期三肖:猪蛇鸡 |

| 043期二肖:猪蛇 |

| 043期一肖:猪 |

043期⑩码:18.12.20.31.40.42.48.08.07.28 |

| 043期⑤码:18.12.20.31.40 |

| 台湾六合彩官方指定网129370.com |

| 041期五肖:猪狗鸡猴鼠 |

| 041期四肖:猪狗鸡猴 |

| 041期三肖:猪狗鸡 |

| 041期二肖:猪狗 |

| 041期一肖:猪 |

041期⑩码:30.43.32.45.41.42.31.08.09.05 |

| 041期⑤码:30.43.32.45.41 |

| 台湾六合彩官方指定网129370.com |

| 037期五肖:兔猪马蛇羊 |

| 037期四肖:兔猪马蛇 |

| 037期三肖:兔猪马 |

| 037期二肖:兔猪 |

| 037期一肖:兔 |

037期⑩码:02.18.11.24.10.26.30.47.36.34 |

| 037期⑤码:02.18.11.24.10 |

| 台湾六合彩官方指定网129370.com |

| 035期五肖:羊龙猴狗鸡 |

| 035期四肖:羊龙猴狗 |

| 035期三肖:羊龙猴 |

| 035期二肖:羊龙 |

| 035期一肖:羊 |

035期⑩码:10.01.33.31.20.22.37.09.19.08 |

| 035期⑤码:10.01.33.31.20 |

| 台湾六合彩官方指定网129370.com |

| 034期五肖:马蛇羊虎鼠 |

| 034期四肖:马蛇羊虎 |

| 034期三肖:马蛇羊 |

| 034期二肖:马蛇 |

| 034期一肖:马 |

034期⑩码:11.24.10.15.05.35.48.34.27.29 |

| 034期⑤码:11.24.10.15.05 |

| 台湾六合彩官方指定网129370.com |

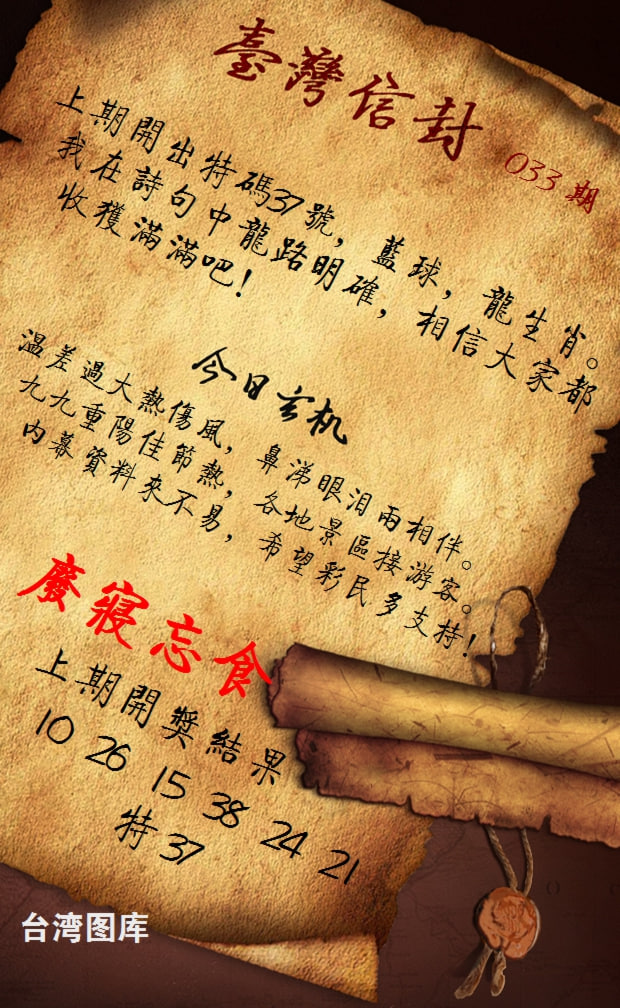

| 033期五肖:狗牛鸡鼠兔 |

| 033期四肖:狗牛鸡鼠 |

| 033期三肖:狗牛鸡 |

| 033期二肖:狗牛 |

| 033期一肖:狗 |

033期⑩码:31.28.32.29.26.07.40.20.17.14 |

| 033期⑤码:31.28.32.29.26 |

| 台湾六合彩官方指定网129370.com |

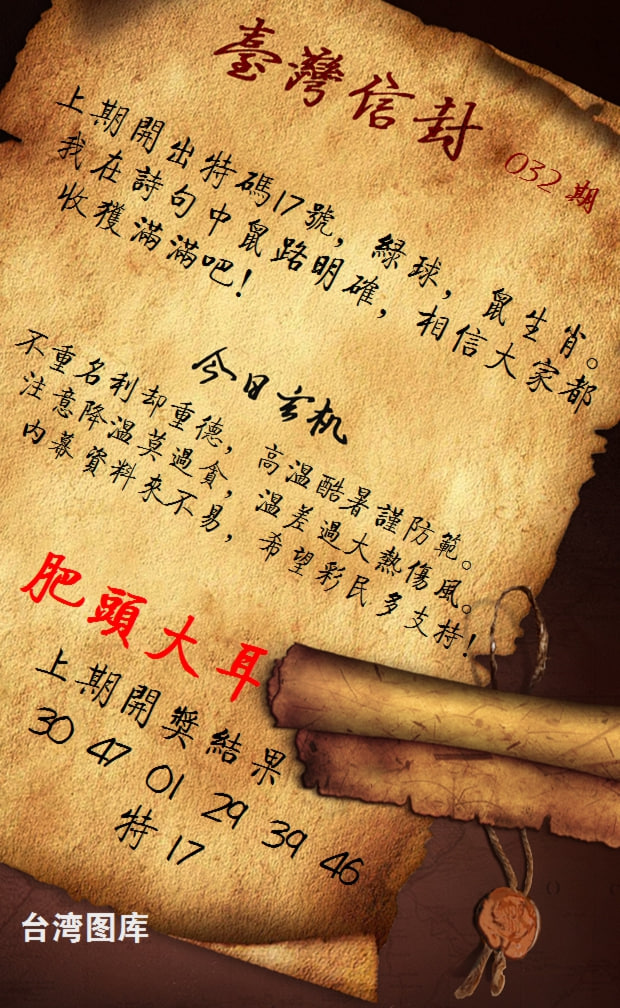

| 032期五肖:猴虎兔蛇龙 |

| 032期四肖:猴虎兔蛇 |

| 032期三肖:猴虎兔 |

| 032期二肖:猴虎 |

| 032期一肖:猴 |

032期⑩码:21.15.14.24.13.09.39.02.36.49 |

| 032期⑤码:21.15.14.24.13 |

| 台湾六合彩官方指定网129370.com |

台湾六合彩【三肖中特】

| 041期:三肖中特『猪羊猴』开:猪18准 |

| 045期:三肖中特『虎鸡龙』开:?00准 |

| 000期:三肖中特『更新中』开:?00准 |

| 000期:三肖中特『更新中』开:?00准 |

| 000期:三肖中特『更新中』开:?00准 |

兰州红姐【原创解特】

| 045期独家玄机:丹阳郭里送行舟,一别心知两地秋。 解释:【出自】丹阳,地秋 开奖结果:?00准 |

| 044期独家玄机:五原春色舊来遲,正是長安花落時。 解释:【出自】五原,落時 开奖结果:羊10准 |

| 043期独家玄机:兰亭雅会众群贤,曲水流觞舍管弦。 解释:【出自】群贤,管弦 开奖结果:蛇24准 |

| 042期独家玄机:到底是谁居丽首,牡丹艳冠百花场。 解释:【出自】丽首,花场 开奖结果:龙01准 |

| 041期独家玄机:幸有惜花人早起,培回根本复栽生。 解释:【出自】早起,栽生 开奖结果:猪18准 |

| 040期独家玄机:特码圆梦一七齐,二前惆怅十牡丹。 解释:【出自】七齐,牡丹 开奖结果:蛇24准 |

| 039期独家玄机:忧心如焚染时病,进退失据求神明。 解释:【出自】时病,神明 开奖结果:龙01准 |

| 038期独家玄机:红比绿强任你选,合数拣单不会错。 解释:【出自】你选,会错 开奖结果:马11准 |

| 037期独家玄机:木呆奉法收悟净,不到黄河心不死。 解释:【出自】悟净,不死 开奖结果:马35准 |

| 036期独家玄机:三五连四合九开,今期三六正有码。 解释:【出自】九开,有码 开奖结果:牛28准 |

| 035期独家玄机:财神网址须谨记,玄机特码八九来。 解释:【出自】谨记,九来 开奖结果:狗31准 |

| 034期独家玄机:得失看轻常闲人,上品夫妻话投机。 解释:【出自】闲人,投机 开奖结果:鼠17准 |

| 033期独家玄机:叫一声天下必亮,有七带二三相逢。 解释:【出自】心亮,相逢 开奖结果:鸡32准 |

| 032期独家玄机:一克容情造干坤,下邳域曹操廛兵。 解释:【出自】干坤,廛兵 开奖结果:龙37准 |

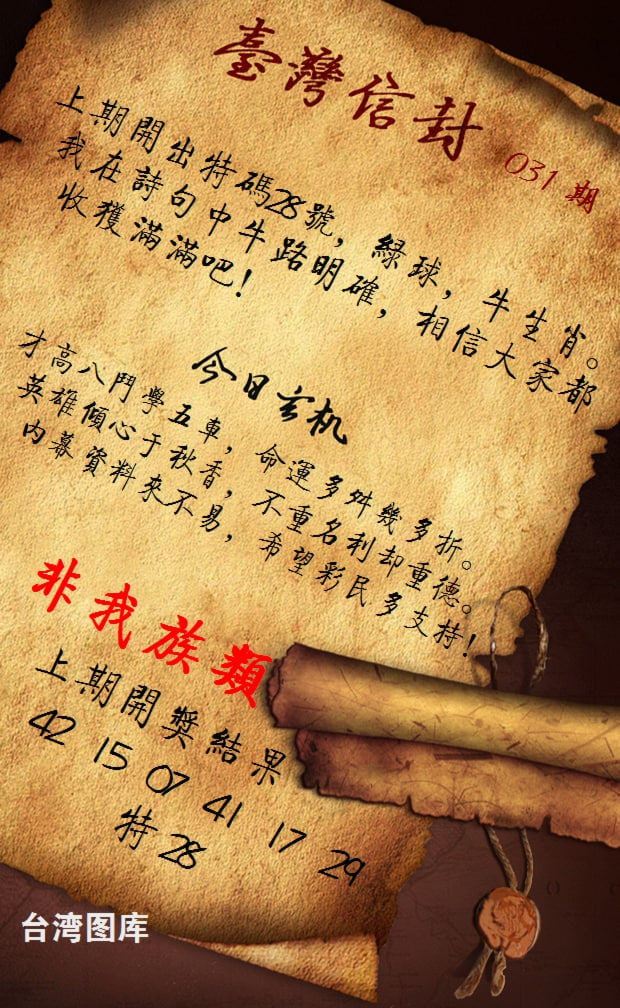

| 031期独家玄机:天津泰富八金融,一等奖我很坚强。 解释:【出自】金融,坚强 开奖结果:鼠17准 |

| 030期独家玄机:三言两语难话尽,一年目标差得多。 解释:【出自】话尽,得多 开奖结果:牛28准 |

| 029期独家玄机:绿特防蓝中合双,火土特肖有你看。 解释:【出自】合双,你看 开奖结果:狗31准 |

| 028期独家玄机:发财赢尽在良机,三三幸有好日月。 解释:【出自】良机,日月 开奖结果:羊22准 |

| 027期独家玄机:如履薄冰怕机关,三言两语说不清。 解释:【出自】机关,不清 开奖结果:鼠05准 |

| 026期独家玄机:三五一群观风景,热闹非凡一同歌。 解释:【出自】风景,同歌 开奖结果:马47准 |

| 025期独家玄机:冷门特码在图中,一叶不服也不让。 解释:【出自】图中,不让 开奖结果:龙25准 |

| 024期独家玄机:可二减到方便问,炎热四同和恶化。 解释:【出自】便问,恶化 开奖结果:鸡08准 |

| 023期独家玄机:政经平稳奔小康, 四肢愿劳乐三餐。 解释:【出自】小康,三餐 开奖结果:猴45准 |

| 022期独家玄机:自称山中一大王,三前当头四为尾。 解释:【出自】大王,为尾 开奖结果:猪06准 |

| 021期独家玄机:想中特碱走大门, 三十无情却无语。 解释:【出自】大门,无语 开奖结果:牛16准 |

| 020期独家玄机:蛇马相见恨见晚,鸡走前后牛跟来。 解释:【出自】见晚,跟来 开奖结果:虎03准 |

台湾六合彩【24码中特】

| 045期:『24码中特』开:?00准 【01.02.04.05.09.11.13.14】 【15.18.19.20.21.25.27.28】 【29.32.35.37.41.43.44.49】 |

| 041期:『24码中特』开:猪18准 【17.18.21.23.26.27.30.31】 【32.33.35.36.38.39.41.43】 【04.05.06.07.11.13.15.16】 |

| 038期:『24码中特』开:马11准 【01.05.06.07.08.11.12.13】 【17.21.22.24.26.27.30.31】 【32.34.36.37.38.39.41.44】 |

| 036期:『24码中特』开:牛28准 【35.37.38.39.41.42.45.48】 【19.22.23.25.27.28.32.34】 【01.06.07.08.09.11.15.18】 |

| 035期:『24码中特』开:狗31准 【02.04.05.08.10.12.16.18】 【19.23.24.26.27.28.30.31】 【33.35.38.39.40.44.46.47】 |

| 032期:『24码中特』开:龙37准 【01.02.05.07.11.12.15.16】 【18.19.23.25.27.28.31.32】 【33.34.37.38.41.44.45.49】 |

| 031期:『24码中特』开:鼠17准 【01.03.05.06.07.08.14.16】 【17.18.19.20.26.28.30.31】 【33.36.37.41.42.46.47.48】 |

| 030期:『24码中特』开:牛28准 【03.04.06.07.08.09.10.15】 【16.17.18.19.23.27.28.32】 【36.39.40.41.43.47.48.49】 |

| 029期:『24码中特』开:狗31准 【01.03.05.06.09.10.12.13】 【17.19.24.25.26.28.29.31】 【37.38.39.40.42.43.48.49】 |

| 027期:『24码中特』开:鼠05准 【02.05.12.13.14.15.17.18】 【20.21.23.25.26.27.28.29】 【30.33.38.40.41.42.44.46】 |

| 026期:『24码中特』开:马47准 【01.02.05.06.09.11.13.14】 【15.17.19.20.22.26.27.33】 【37.38.40.41.44.45.46.47】 |

台湾六合彩【绝杀㈡尾】

| 045期:绝杀㈡尾『0尾.2尾』开:?00准 |

| 044期:绝杀㈡尾『1尾.3尾』开:羊10准 |

| 043期:绝杀㈡尾『8尾.9尾』开:蛇24准 |

| 042期:绝杀㈡尾『7尾.8尾』开:龙01准 |

| 040期:绝杀㈡尾『6尾.7尾』开:蛇24准 |

| 039期:绝杀㈡尾『5尾.6尾』开:龙01准 |

| 038期:绝杀㈡尾『4尾.5尾』开:马11准 |

| 037期:绝杀㈡尾『3尾.4尾』开:马35准 |

| 036期:绝杀㈡尾『1尾.2尾』开:牛28准 |

| 035期:绝杀㈡尾『9尾.0尾』开:狗31准 |

| 034期:绝杀㈡尾『8尾.9尾』开:鼠17准 |

| 033期:绝杀㈡尾『7尾.8尾』开:鸡32准 |

| 029期:绝杀㈡尾『6尾.7尾』开:狗31准 |

| 028期:绝杀㈡尾『5尾.6尾』开:羊22准 |

| 026期:绝杀㈡尾『4尾.5尾』开:马47准 |

| 025期:绝杀㈡尾『2尾.3尾』开:龙25准 |

| 024期:绝杀㈡尾『5尾.7尾』开:鸡08准 |

| 023期:绝杀㈡尾『4尾.6尾』开:猴45准 |

| 021期:绝杀㈡尾『3尾.5尾』开:牛16准 |

| 020期:绝杀㈡尾『2尾.4尾』开:虎03准 |

台湾六合彩【综合绝杀】

| 期数 | 杀肖 | 杀半波 | 杀一尾 | 禁一头 | 开奖结果 |

| 045期 | 猪 | 蓝双 | 3尾 | 1 | 开?00 |

| 044期 | 牛 | 红单 | 4尾 | 0 | 开羊10 |

| 043期 | 狗 | 红双 | 6尾 | 2 | 开蛇24 |

| 042期 | 猪 | 蓝单 | 4尾 | 0 | 开龙01 |

| 041期 | 羊 | 绿双 | 3尾 | 1 | 开猪18 |

| 040期 | 龙 | 红单 | 1尾 | 3 | 开蛇24 |

| 039期 | 鼠 | 蓝双 | 5尾 | 4 | 开龙01 |

| 038期 | 虎 | 绿单 | 2尾 | 2 | 开马11 |

| 037期 | 兔 | 红双 | 8尾 | 0 | 开马35 |

| 036期 | 鸡 | 蓝单 | 6尾 | 4 | 开牛28 |

| 035期 | 猴 | 绿双 | 9尾 | 3 | 开狗31 |

| 034期 | 狗 | 红双 | 7尾 | 2 | 开鼠17 |

| 033期 | 蛇 | 蓝单 | 5尾 | 1 | 开鸡32 |

| 032期 | 马 | 绿单 | 3尾 | 0 | 开龙37 |

| 031期 | 牛 | 红双 | 1尾 | 4 | 开鼠17 |

| 030期 | 鼠 | 蓝双 | 2尾 | 1 | 开牛28 |

| 029期 | 羊 | 绿单 | 0尾 | 3 | 开狗31 |

| 028期 | 猪 | 红单 | 9尾 | 2 | 开羊22 |

| 027期 | 鸡 | 蓝单 | 8尾 | 0 | 开鼠05 |

| 026期 | 狗 | 绿单 | 7尾 | 4 | 开马47 |

| 025期 | 牛 | 红双 | 6尾 | 3 | 开龙25 |

| 024期 | 蛇 | 蓝双 | 5尾 | 1 | 开鸡08 |

| 023期 | 马 | 绿单 | 8尾 | 2 | 开猴45 |

| 022期 | 牛 | 红双 | 6尾 | 3 | 开猪06 |

| 021期 | 鼠 | 蓝双 | 2尾 | 0 | 开牛16 |

台湾权威专家出版稳赚平特

011-013期【蛇肖】011中中中!

012-014期【蛇肖】012中中中!

013-015期【狗肖】014中中中!

018-020期【狗肖】019中中中!

020-022期【狗肖】020中中中!

021-023期【狗肖】021中中中!

022-024期【鸡肖】022中中中!

023-025期【鼠肖】024中中中!

025-027期【鼠肖】025中中中!

026-028期【鼠肖】027中中中!

028-030期【牛肖】030中中中!

031-033期【马肖】031中中中!

034-036期【猪肖】035中中中!

036-038期【猪肖】038中中中!

039-041期【龙肖】039中中中!

040-042期【龙肖】040中中中!

041-043期【龙肖】042中中中!

043-045期【虎肖】043中中中!

| 台湾挂牌浅解 |

| 045期挂牌解析:【葵花向日】 【释义】是一种古老的成语,用来形容人或物向阳而生长,积极向上。 综合三肖:兔马龙 综合一肖:兔 |

| 042期挂牌解析:【扒高踩低】 【释义】是指在比较中夸大一方的优点,贬低另一方的缺点,以达到对比的目的。 综合三肖:羊猴龙 综合一肖:羊 |

| 041期挂牌解析:【不见圭角】 【释义】是用来形容某个人突然失踪或消失不见的情况。 综合三肖:羊牛鸡 综合一肖:羊 |

| 039期挂牌解析:【匡鼎解颐】 【释义】是纠正国家政治的错误,解除国家颠倒。 综合三肖:虎鸡龙 综合一肖:虎 |

| 038期挂牌解析:【贪荣慕利】 【释义】是指一个人贪图享乐和利益,追求名利,不择手段地追求个人利益的行为。 综合三肖:狗牛鸡 综合一肖:狗 |

| 037期挂牌解析:【让枣推梨】 【释义】是一个常见的短语或俗语,可能是一种幽默或玩笑的说法。 综合三肖:龙羊牛 综合一肖:龙 |

| 034期挂牌解析:【狂风巨浪 】 【释义】通常用来形容海上风浪非常猛烈,表示风势强大且海浪高涨的场面。 综合三肖:鸡鼠牛 综合一肖:鸡 |

| 032期挂牌解析:【风和日美 】 【释义】是一个成语,形容风和日丽、天气晴朗、景色优美的美好时光。 综合三肖:羊兔龙 综合一肖:羊 |

| 028期挂牌解析:【东鳞西爪】 【释义】是中国古代的一个成语,意思是贩卖奴隶和皂隶(即皂隶,即古代的佃户或佃农)的人,代表着卑贱和恶劣的行为。 综合一肖:虎 |

| 027期挂牌解析:【贩夫皂隶】 【释义】是指行为或态度显得很有自信、威风或有威严的样子。 综合一肖:蛇 |

| 026期挂牌解析:【大模大样】 【释义】指对某人或某物感到非常敬畏和尊敬的状态,心生敬畏之情。 综合一肖:鸡 |

| 025期挂牌解析:【竦然起敬】 【释义】是形容一个人容貌清秀、眉目间精致秀丽的一种说法。 综合一肖:鸡 |

| 023期挂牌解析:【舛讹百出】 【释义】是一个成语,形容在某种情况下非常坚决、不退让,甚至毫不让步。 综合一肖:鸡 |

TG广告联系:@chinaa66

站长广告唯一收款地址

(trc20):TWejhRZj*******sNLFodSa

免责声明:以上所有广告内容均为彩票赞助商提供,本站不对其经营行为负责。浏览或使用者须自行承担有关责任,本网站恕不负责。

【台湾六合彩】域名:www.042422.com

六合在线,收集各类台湾六合彩资料,免费内幕资料,走势分析,尽在台湾六合彩